- Úvod

- Hedge Funds

Hedge Funds

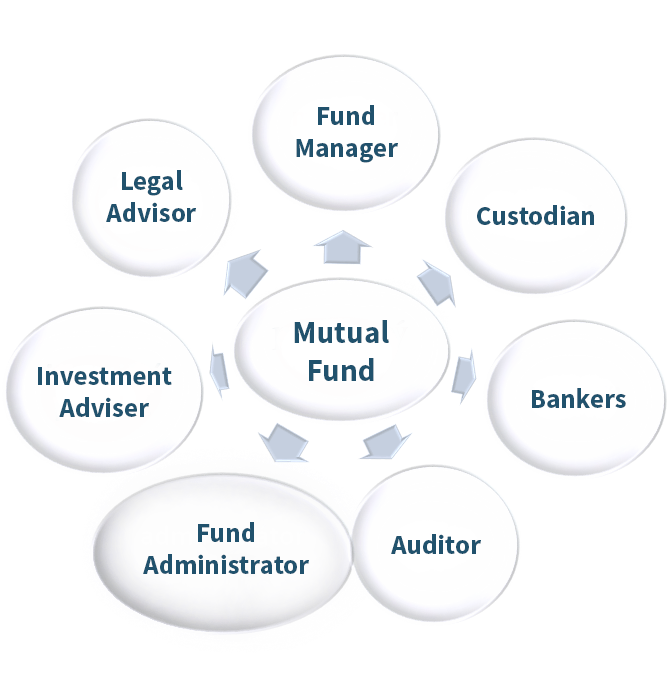

Mutual/hedge fund characteristics

Collective investment vehicle that pools money from investors and invests in a number of instruments including stocks, bonds, options, commodities, money market instruments and other investment securities.

The income earned through these investments and the capital appreciation realized by the fund, are shared by its investors in proportion to the number of units owned by them.

Provides an element of risk spreading through diversification.

Statute law and licensing authority

Seychelles’ statute law on mutual funds is contained in the Mutual Fund and Hedge Fund Act, 2008. The governing body for mutual funds in Seychelles is the, Financial Services Authority (FSA). The FSA is conferred powers of licensing and regulation of the mutual funds in Seychelles.

Mutual/hedge funds constitution

Mutual Funds may be lawfully constituted as a:

- cooperatives

- Limited partnership incorporated in Seychelles under the Limited Partnerships Act 2003 or a similar partnership incorporated in a recognized jurisdiction.

- trading companies

- A company governed by the International Business Companies Act 1994

- A company under the Companies Act, 1972 together with companies under the Companies Act, 2003 (Special Licence)

- mutual fund

- A mutual fund registered in Seychelles under the International Funds Act 1994, or a similar fund registered in a recognized jurisdiction.

| Seychelles as a country and popular jurisdiction | Modern, expedient and flexible Seychelles Mutual fund law |

|---|---|

| Proven track record with a steady growth (10%+) | Is an extensively researched law |

| Outstanding political and social stability | Is an enabling law |

| On the white list of OECD and IMF compliant | Regulator flexibility |

| Convenient time zone at GMT+4 | Enhanced privacy |

| Excellent facilities in terms of service providers, communications, service businesses etc. | Provides a variety of organizational forms and fund options |

| Attractive corporate and personal tax environment | Allows the foreign funds from a recognized jurisdictions and Umbrella funds |

| Free remittance of profits and capital | No minimum capital requirements or statutory limitations |

The most common structure for a Seychelles Mutual Fund: International Business Company.

Types of mutual funds

The Seychelles Mutual Fund and Hedge Fund Act prescribes four different types of funds:

Private Fund

- No more than 50 investors

- Private business connection

- Aimed at the professional adviser looking to gather together a consortium of investors

- Prohibits any invitation to public to subscribe for shares

- No minimum or maximum investment required

Public Fund

- A Mutual Fund that is not a Private Mutual Fund or Professional Fund

- Designed to be mass marketed

- Applicant needs to furnish a detailed offering document

- The Authority demands that all risks and plans of the fund are disclosed upfront to the investors

Professional Fund

- Aimed for Professionals of High Net investors with the initial minimum investment per investor being 100,000 USD

- Recognized Banks, Mutual Funds, Insurance Companies and Securities dealers etc.

Exempt Foreign Fund

- Already licensed as a mutual fund in a recognized jurisdiction

- Is not required to hold Seychelles fund license

- Must be administered by a Seychelles licensed fund administrator

- Is either listed on a stock Exchange or provides for a minimum investment of not less than 100,000 USD

Umbrella funds

The Seychelles Mutual Fund Law is flexible enough to cater also for Umbrella funds. An umbrella fund:

- consists of multiple sub-funds within the overall fund structure/fund entity that in effect operates as individual investment fund

- enables funds with different strategies to be created within the same legal structure, reducing the funds’ costs.

- makes it less expensive and more convenient for investors to switch investments from one fund to another

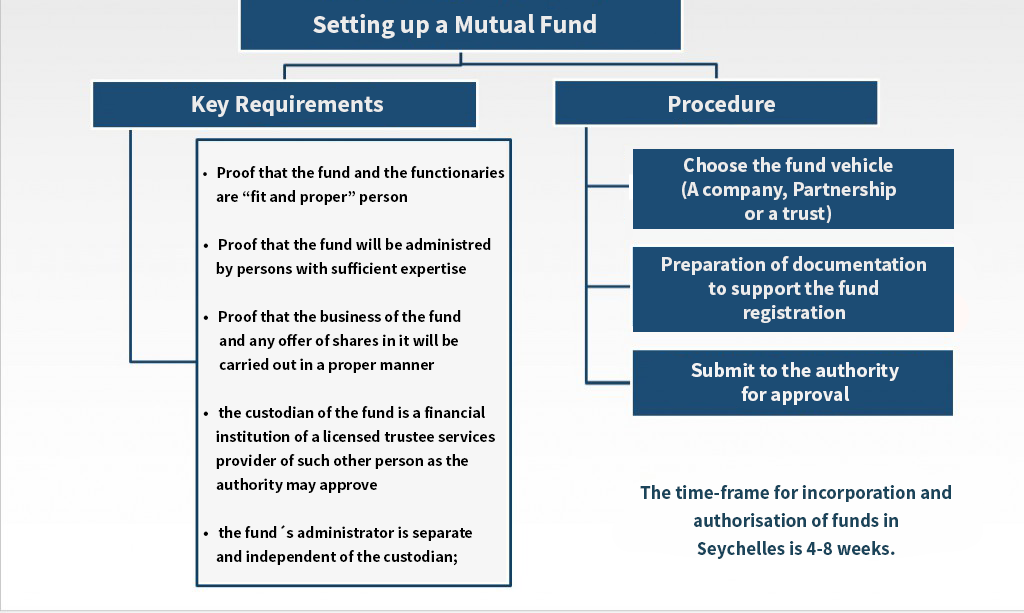

Application for fund license

The Authority (FSA) may authorize a fund provided a complete application is received. The documents accompanying an application form for authorization usually include:

- a current or latest draft offering document in relation to the fund

- certified true copies of the constitutional documents

- personal questionnaire for each director, trustee or general partner (unless the equity interests in the applicant or its controlling shareholder or beneficial owner are listed on a stock exchange of a recognized jurisdiction)

- written consent of the proposed fund administrator stating his consent to act in the fund and acceptance of the name of the fund

- written consent of the proposed auditor, legal advisor and custodian, stating their consent to act as the respective functionary of the fund and the acceptance of the name of the fund

- three year financial forecast of cash flow statements

The Authority (FSA) is entitled to require any other supporting information. The application is subject to fee. Additional requirements as to public funds and tax exempt foreign funds include the following;

- Public Funds

- a licensed public fund must adopt an offering document

- must submit a draft of aforesaid document to the Authority for approval and registration prior to each new offering

- Exempt foreign funds

- are exempted from the licensing procedure

- shall apply for tax exemption as an Exempt Foreign Fund by submitting the following documents to the Authority:

- fully and properly completed approval application form

- certified true copies of the license or other authorization granted by a regulatory body in a recognized jurisdiction

- proof that the fund is to be administered by a fund administrator licensed in Seychelles.

- the current or latest draft offering document.

- the exemption application fee

| Application Fee | Annual License Fee | |

|---|---|---|

| Private Fund | $ 500 | $ 500 |

| Public Fund | $ 1000 | $ 1000 |

| Professional Fund | $ 750 | $ 750 |

| Except foreign Fund | $ 1500 | $ 1500 |

What do we offer for mutual funds?

Start-up

- providing comprehensive advice on the application process and legal requirements

- Drafting of offering document / Fund Prospectus

- Introduction to auditors, Bankers, Legal & Investment Advisors and other functionaries

- Drafting agreements between the Fund manager and the other fund functionaries / Pls

Set-up

| Features | BVI | Cayman Islands | Mauritius | Seychelles |

|---|---|---|---|---|

| Types of Fund | • Private Fund | • Licensed l Fund | • Professional CIS | • Private Fund |

| • Professional Fund | • Administered Fund | • Expert Funds | • Professional Fund | |

| • Public Fund | • Registered Fund | • Specialized CIS | • Public Fund | |

| • Exempt Fund | • Private Fund | • Exempt Foreign Fund | ||

| • Close-end Funds | ||||

| Types of vehicle | • Companies | • Companies | • Companies | • Companies |

| • Limited Partnership | • Limited Partnership | • Trust | • Limited Partnership | |

| • Unit Trust | • Unit Trust | • Unit Trust | ||

| Incorporation Procedure | • Incorporated as and ordinary business company | • Incorporated as an exempted company by filling MOA, AOA with Registrar | • Application for incorporation are made to the Registrar of companies | • Fillig with registrar; |

| • By filing MOA, AOA, Prospectus and Agreements with the Registrar of corporate Affairs | • For regulated funds before launch CIMA must approve the documents | • Application for authorization of CIS and GBC I are made to FSC | • Current offering documents | |

| • Address of the registered office | ||||

| • Written consent of the fund administrator | ||||

| • Conditions for Exempt Foreign Funds | ||||

| • Filled in application form | ||||

| • Certified true copy of the authorized license from the recognized jurisdiction | ||||

| • Certificate of good standing | ||||

| • Current or latest draft offering document | ||||

| • Proof that the fund is administered by the fund administrator | ||||

| Time taked for Incorporation | • Same day incorporation possible | • Incorporated within 24 hours once the due diligence norms are met | • Incorporated within 24 hours once the due diligence norms are met | • Incorporated within 24 hours once the due diligence norms are met |

| • Professional Funds can carry on business for period of max. 14 days without any recognition | ||||

| Local Requirements | • Registered Office | • Registered Office | • Registered Office | • Registered Office |

| • Min. 1 director | • Minimum 2 individual directors | • 2 directors based in Mauritius | • Licensed Registered Agent | |

| • Certified copies of the various functionaries to be filed with the Registrar of companies if located outside BVI and categorized under recognized jurisdiction | • Corporate directors are permitted in certain circumstances | • Must have a principal bank account and accounting records based in Mauritius | • Min. 1 director | |

| • The functionaries of Mutual funds can be based out of Seychelles with true copy of certificates registered | ||||

| Auditors | • A Public fund must appoint an auditor accepted by FSC | • A regulated fund must appoint an auditor based in Cayman | • Must appoint a local auditor | • A Seychelles Funds must appoint an auditor and the auditing of accounts of Seychelles funds and fund administrators can be audited by approved and recognized overseas auditors |

| • A Private and Professional fund need not to appoint an auditor | • Unregulated and Private funds do not have to appoint a auditor |

- incorporating the Fund entity (A Company, Partnership or a Trust)

- Compliance and Regulatory services

- provision of registered agent and registered office services for the fund entity

- compiling and submitting the Fund license application to the authority for approval

- attending to the annual renewal of licenses

Administration

- full reporting and accounting services

- maintenance of books and records namely, share registers, register of directors etc.

- Net Asset Value calculations

Investment research

- Investment Research to support portfolio selection decisions

Our core services

- structuring, formation and administration of offshore corporate structures

- Trust Services

- additional Corporate Services – Offshore Bank Account Establishment and Management, Tax planning and evidence etc.

- private Client Trusts and fiduciary services

- accounting services

- preparation of offering documents and marketing materials

- selected Industry Research

- Fund Set-up – One off first year fees

| No. | Particulars | Cost (USD) |

|---|---|---|

| 1. | Professional Fee (standard/specialized fee/reward) Which includes; collation, preparation review and filing of Fund Licence application documents, basic review of offering document, assistance with initial set up and organization of the fund and liaising with regulator and other service providers | 13,000 – 19,000 |

| 2. | Preparation of the private offering memorandum Standard document free of charge; any customizations or changes may have some charges | |

| 3. | Government Fees – Application Fee | 750 |

| 4. | Government Fees – Fund Licence fee | 750 |

| TOTAL: | 14,500 – 20,500 |

Fund – Annual Renewal Fees

| No. | Particulars | Cost (USD) |

|---|---|---|

| 1. | Annual fee for continuation and Maintenance of the Fund | 7,000 |

| 2. | Government Fee – Annual Licence Renewal Fee | 750 |

| TOTAL: | 7,750 |

Fund Entity Set up : IBC Formation – First year Fees

| No. | Particulars | Fee (USD) |

|---|---|---|

| 1. | Incorporation fee (Including incorporation documents preparation, submission and government Fee of USD 100 and Tax of USD 15) | 350 |

| 2. | IBC Registered Office Fee | 200 |

| 3. | IBC Registered Agent Fee | 500 |

| TOTAL: | 1,050 |

Fund Entity: IBC: Annual Renewal Fees

| No. | Particulars | Fee (USD) |

|---|---|---|

| 1. | Annual Renewal fee (Including government annual fee of USD 100 and Tax of USD 10) | 200 |

| 2. | IBC Registered Office Fee | 200 |

| 3. | IBC Registered Agent Fee | 500 |

| TOTAL: | 900 |

Fund Administration Fees:

| No. | Particulars | Fee (USD) |

|---|---|---|

| 1. | Bookkeeping and NAV calculations, Registry, secretarial and trade and settlement coordination | Based on Size of Fund, number and nature of Transaction |

| 2. | Preparation of Annual Financial Statements | Based on Size of Fund, number and nature of Transactions |

| 3. | Other Administration Work | Charged on time – spent Basis |

Other Services

| No. | Particulars | Fee (USD) |

|---|---|---|

| 1. | Legal Advisory Services – Annual Retainer | 2,500 |

| 2. | Auditing Services* | On application |

We will be happy to help you set up your Mutual Fund. Please do not hesitate to contact us.

Parker & Hill

All services

Offshore companies

Advantages

| entering the international market |

| tax relief |

| less paperwork |

| incl. bookkeeping |

Interested in more?

Complexity

Establishment of the company, its settlement, delivery of apostilled documentation, bookkeeping. All under one agency.

Support

Do you have a foreign company and don’t know if you have fulfilled all your legal obligations? We can help you to check and comply with all government requirements.

Management

Are you dissatisfied with the performance of your directors? Are they not meeting deadlines? Try us.

Fair price

Do you already have an offshore company? Do you want better conditions? Change your registration agent.

Parker & Hill

Reliably & happy to help you

Quick contact

-

Žitná 562/10

-

Praha 2, 120 00

Our partners

In 1996 we became a registration agency as Parker & Hill Ltd. In 2011 we underwent a transformation and began to operate internationally under Parker & Hill Inc.

We are a member of the international consortium NWMS Ltd. We incorporate companies directly for you within 16 jurisdictions. We are not re-seller, we are the registration agency.

© Parker & Hill 2021 | All rights reserved | admin